Media monitoring strategies for growing startups

Media monitoring strategies are vital for growing startups to track brand mentions, understand market perception, and identify opportunities for growth. Effective media monitoring enables startups to manage their reputation, gain competitive intelligence, and make data-driven decisions despite limited resources. By implementing targeted monitoring across digital, social, and traditional media channels, startups can develop agile responses to market changes, engage with audiences effectively, and drive strategic growth initiatives based on real-time intelligence.

Why is media monitoring essential for growing startups?

Media monitoring is essential for growing startups because it provides critical visibility into brand perception, market trends, and competitive landscape at a stage when reputation and positioning are most vulnerable. For resource-constrained startups, understanding how their brand is perceived in the market offers an invaluable strategic advantage.

Startups face unique challenges that make media intelligence particularly important. Unlike established companies, startups are actively defining their market position and building their reputation from the ground up. Every mention, whether positive or negative, can significantly impact growth trajectory. Media monitoring allows startups to:

- Identify and address potential PR issues before they escalate

- Track competitor movements and industry developments

- Discover partnership opportunities and potential investors

- Validate messaging effectiveness and refine communication strategies

The challenge for startups lies in implementing comprehensive monitoring with limited budgets and team bandwidth. Many struggle to determine which channels deserve priority and how to transform data into actionable insights without dedicated analytics teams.

What are the core components of an effective media monitoring strategy?

An effective media monitoring strategy for startups consists of four essential components: comprehensive source coverage, real-time alerting capabilities, sentiment analysis, and actionable reporting frameworks. These elements work together to create a holistic view of a startup’s media presence while remaining manageable for small teams.

Comprehensive source coverage involves monitoring across multiple channels where relevant conversations happen:

- News sites and industry publications

- Social media platforms (focusing on those most relevant to target audience)

- Forums and review sites

- Blogs and thought leadership platforms

Real-time alerts ensure startups can respond quickly to emerging opportunities or threats. This capability transforms media monitoring from a retrospective analysis tool to a proactive business intelligence resource.

Sentiment analysis helps startups understand not just when they’re mentioned, but the context and emotional tone behind those mentions. This qualitative dimension provides crucial context for interpretation.

Finally, actionable reporting frameworks convert raw monitoring data into insights that can directly inform business decisions. For startups with limited resources, focusing on streamlined, insight-driven reports rather than overwhelming data dumps is essential.

How can startups implement media monitoring on a limited budget?

Startups can implement effective media monitoring on limited budgets by combining free tools, prioritizing channels based on audience presence, and focusing on high-impact metrics aligned with specific growth objectives. This strategic approach ensures valuable insights without unnecessary expenditure.

Begin with these affordable media monitoring approaches:

- Utilize free tools like Google Alerts, TalkWalker Alerts, and social media native search functions

- Implement RSS feeds from key industry publications

- Use social listening tools with free tiers such as Hootsuite or Buffer

- Consider focused paid solutions that offer scalable pricing models for startups

Channel prioritization is crucial for resource efficiency. Rather than attempting to monitor everything, startups should identify where their most valuable audiences engage and concentrate efforts there. This might mean focusing on Twitter and industry forums while deprioritizing platforms with less relevant activity.

Scheduling regular but manageable monitoring sessions helps maintain consistency without overwhelming teams. Consider dedicating specific times each day or week for reviewing alerts, rather than constant checking that disrupts other priorities.

As the startup grows, media monitoring efforts can scale accordingly, gradually incorporating more sophisticated tools and expanding channel coverage when resources allow.

What metrics should startups track in their media monitoring efforts?

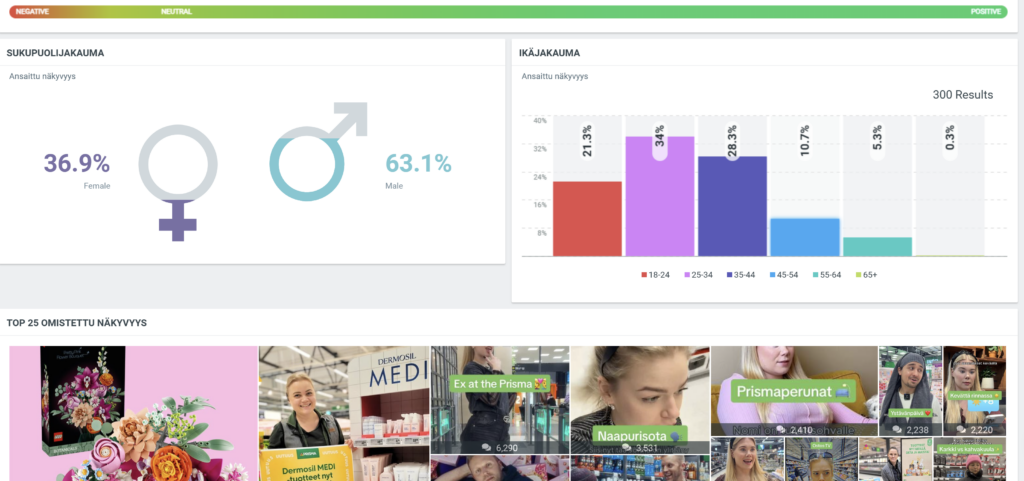

Startups should track metrics that directly connect media performance to business outcomes, focusing on share of voice, sentiment trends, message penetration, competitive positioning, and conversion correlations. These specific indicators provide meaningful context for growth-stage companies without generating overwhelming data.

The most valuable startup PR monitoring metrics include:

- Share of Voice (SoV): How much of the conversation in your industry features your brand compared to competitors

- Sentiment Ratio: The proportion of positive to negative mentions over time

- Message Penetration: Whether key messaging points are being picked up and repeated in media coverage

- Engagement Quality: Not just counting interactions but assessing which types lead to meaningful business outcomes

- Referral Traffic: How media mentions translate to website visits and subsequent conversions

For early-stage startups, tracking changes in these metrics over time often provides more actionable insights than absolute numbers. Establishing baselines and measuring improvement relative to company growth stages helps contextualize performance appropriately.

Startups should also monitor competitor metrics to benchmark performance and identify potential gaps or opportunities in the market that could be strategically exploited.

How can startups turn media monitoring insights into actionable growth strategies?

Startups can transform media monitoring insights into actionable growth strategies by systematically connecting media intelligence to specific business objectives, operational decisions, and tactical executions. This translation process turns passive monitoring into a strategic growth driver.

Media intelligence for growth becomes actionable when startups:

- Identify emerging industry trends for product development opportunities

- Discover unaddressed pain points mentioned in competitor reviews

- Pinpoint influential voices for strategic partnership outreach

- Refine messaging based on what resonates in earned media

- Time announcements to align with relevant industry conversations

Content strategy refinement represents a particularly valuable application of media monitoring. By analyzing which content topics and formats generate the most engagement and positive sentiment, startups can focus limited content creation resources on high-impact areas.

For fundraising stages, media monitoring helps startups build compelling narrative evidence of market traction and audience engagement. Demonstrating awareness of market positioning and competitive differentiators signals sophistication to potential investors.

Crucially, startups should establish regular review processes where media insights are directly connected to specific action items, ensuring monitoring translates to execution rather than remaining theoretical.

How can Meedius International support startup media monitoring needs?

Meedius International supports growing startups with scalable media monitoring solutions that combine advanced AI-powered analytics with expert human analysis, allowing startups to access enterprise-grade media intelligence that grows with their evolving needs and resources.

Our brand tracking for startups services are specifically designed to address the unique challenges facing growth-stage companies:

- Flexible monitoring packages that scale with your growth trajectory

- Comprehensive global coverage across all media types

- Customized dashboards focused on metrics that matter most to startups

- Real-time alerts for time-sensitive opportunities and threats

- Expert analysis that translates data into actionable business intelligence

We understand that startups need more than raw data—they need contextual insights that directly inform strategic decisions. Our combination of advanced technology and human expertise ensures startups receive meaningful, actionable intelligence rather than overwhelming data dumps.

As a Nordic partner of the world-leading Talkwalker/Hootsuite platform for online media monitoring and social media listening, we offer comprehensive international solutions that help startups gain the media intelligence advantage typically reserved for larger enterprises, but with the flexibility and scalability that growing companies require.