How often should you perform a competitor analysis?

The optimal frequency for competitor analysis varies by industry, business size, and market volatility, but most businesses should conduct thorough analyses quarterly with continuous lightweight monitoring in between. Fast-moving industries may require monthly comprehensive reviews, while stable sectors might manage with bi-annual or annual deep dives. The key is establishing a consistent schedule that balances the need for current competitive intelligence without creating analysis paralysis or resource drain. Supplementing scheduled analyses with event-triggered reviews when market conditions change significantly ensures your competitive strategy remains responsive and informed.

Understanding competitor analysis in today’s business landscape

Competitor analysis is a systematic examination of your competitors’ strategies, strengths, weaknesses, and market positioning that forms a crucial component of business intelligence. In today’s rapidly evolving markets, understanding your competitive landscape isn’t just advantageous—it’s essential for survival and growth.

The digital transformation has dramatically accelerated market changes, making competitive intelligence more valuable than ever. Businesses that regularly monitor competitors can identify emerging trends, anticipate market shifts, and discover opportunities before they become obvious to everyone.

Determining the right frequency for competitor analysis represents a strategic decision in itself. Too infrequent, and you risk missing critical competitive moves; too frequent, and you may waste resources or become reactive rather than strategic. Finding this balance is particularly important in the media intelligence sector, where information flows continuously and competitive advantages can emerge and disappear quickly.

What factors determine how often you should conduct competitor analysis?

The appropriate frequency for competitor analysis depends on several key factors that vary significantly across businesses and industries. Understanding these variables helps you establish an effective monitoring schedule tailored to your specific needs.

Market volatility stands as perhaps the most significant determinant. Highly dynamic markets with frequent innovations, pricing changes, or new entrants require more regular monitoring than stable, mature markets where competitive positions change gradually.

Your company size and available resources also play crucial roles. Larger organizations with dedicated competitive intelligence teams can sustain more frequent analyses than smaller businesses with limited resources. However, even small companies should prioritize some level of regular competitive monitoring.

Additional factors to consider include:

- Your industry’s typical product development cycle

- The number and activity level of direct competitors

- Regulatory changes affecting your market

- Your current growth strategy and objectives

- The pace of technological change in your sector

How does your industry type affect competitor analysis frequency?

Different industries require distinctly different approaches to competitor analysis frequency due to their inherent characteristics and competitive dynamics. Your industry type should significantly influence how often you collect and analyze competitive intelligence.

In technology, e-commerce, and digital media sectors, where innovation cycles are compressed and market conditions shift weekly, monthly competitor analysis may be necessary. These fast-moving industries benefit from implementing continuous monitoring systems with formal analysis sessions at least monthly.

By contrast, manufacturing, utilities, and other capital-intensive industries with longer product development cycles and high barriers to entry might find quarterly or even semi-annual in-depth analyses sufficient. However, even these businesses should maintain awareness of competitive movements between formal reviews.

Financial services and healthcare represent intermediate cases, typically requiring bi-monthly or quarterly comprehensive analyses supplemented with ongoing monitoring of key market intelligence signals. Regulatory changes in these sectors can also trigger the need for additional competitive assessments.

What are the risks of performing competitor analysis too frequently or too rarely?

Finding the right balance in competitor analysis frequency helps avoid significant risks that come with either extreme. Both over-monitoring and under-monitoring can damage your competitive positioning and waste resources.

Analyzing competitors too frequently can lead to several problems:

- Resource drain and diminished returns on intelligence investment

- Analysis paralysis that delays decision-making

- Strategic whiplash from constant course corrections

- Excessive focus on competitors rather than customers

Conversely, conducting competitor analysis too infrequently creates different but equally problematic issues:

- Missing critical competitive moves or market shifts

- Developing strategic blind spots about emerging threats

- Failing to identify opportunities until competitors capitalize on them

- Operating with outdated assumptions about market conditions

The ideal approach balances these extremes through structured competitive monitoring schedules with flexibility to respond to significant market events. This balanced approach ensures you stay informed without becoming either reactive or complacent.

How can you establish an effective competitor analysis schedule for your business?

Creating a customized competitor analysis schedule requires a strategic approach that aligns monitoring frequency with your specific business needs. Start by categorizing your intelligence needs into three tiers: continuous monitoring, periodic reviews, and comprehensive analyses.

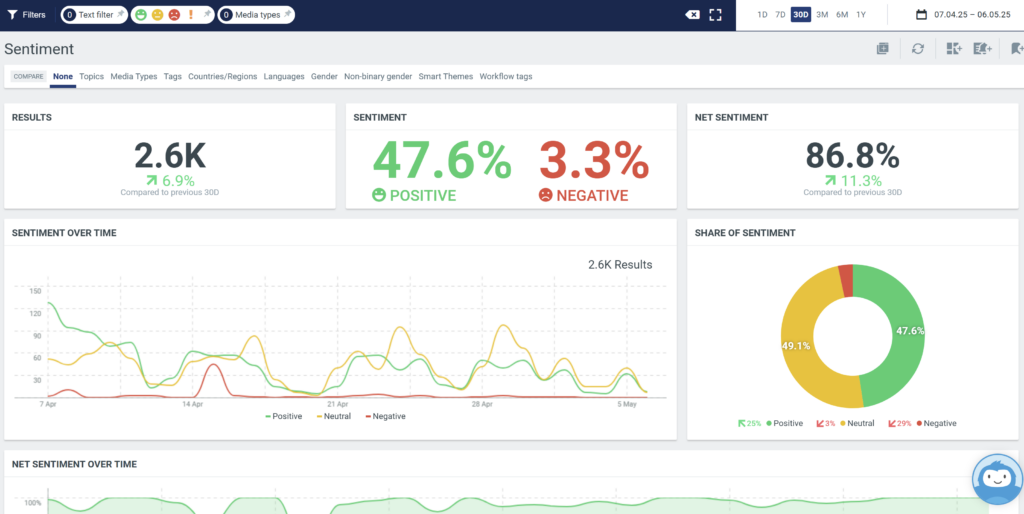

For continuous monitoring, implement automated tools that track competitors’ pricing changes, marketing campaigns, product launches, and social media activities. This lightweight daily or weekly monitoring provides early warning signals without substantial resource investment.

Schedule periodic reviews (monthly or quarterly) to analyze these signals more deeply, identifying patterns and assessing their implications for your business. These reviews should examine tactical competitive moves and short-term market developments.

Reserve comprehensive analyses for quarterly or semi-annual sessions where you thoroughly evaluate competitors’ strategic positions, capabilities, and likely future moves. These deeper analyses should influence your strategic planning and resource allocation decisions.

Customize this framework based on your industry dynamics and resources. Startups and small businesses might combine the periodic and comprehensive reviews to conserve resources while still maintaining competitive awareness. Enterprises can develop more sophisticated multi-tiered systems with specialized business strategy teams dedicated to competitive intelligence.

Key takeaways: Optimizing your competitor analysis with Meedius International

Establishing the right frequency for competitor analysis represents a crucial decision that balances the need for timely information against efficient resource use. Most organizations benefit from a layered approach: continuous lightweight monitoring, regular tactical reviews, and periodic strategic analyses.

Remember that competitor analysis isn’t just about frequency—quality and actionability matter tremendously. Focus on gathering intelligence that directly informs your strategic decisions rather than accumulating data for its own sake.

Meedius International provides sophisticated media intelligence and market analysis solutions that can transform your competitor monitoring processes. Our technology-driven approach combines AI and machine learning with human expertise to deliver comprehensive information solutions that help you focus on what matters most. With capabilities spanning media monitoring, reputation analysis, and competitive intelligence, we enable businesses to implement optimal monitoring frequencies without overwhelming their teams.

By leveraging professional market analysis tools, you can maintain the perfect balance—staying informed about competitive developments without diverting excessive resources from your core business activities.